Complete your answer and submit

Topic 2, Slide Company

Pre-seen case study

You are a senior Finance Manager who works for the Slide Group (‘Slide’). You report directly to the parent company’s Board and advise on special projects and strategic matters. You have compiled the following facts about the company.

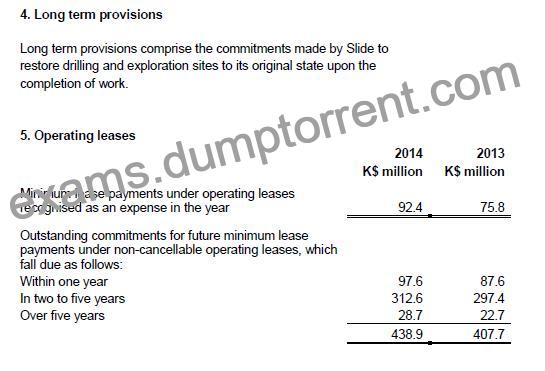

Slide – company Background

Slide was founded in 1954 by Henry Jones. His family owned a large piece of land on a Caribbean Island and a chance discovery revealed the possibility of oil deposits under that land. The family registered Slide as a company to raise finance in order to explore this opportunity and the subsequent find exceeded all expectations.

The success of this first venture encouraged the Jones family, who owned 75% of Slide’s equity shares at that time, to purchase oil exploration rights and to conduct exploratory drilling. The company soon developed considerable expertise in the successful purchase and exploitation of exploration rights.

Henry Jones’ family lived in Kayland, a European country. Slide was listed on Kayland’s stock exchange in 1965. Henry Jones was Chief Executive Officer (CEO) of Slide until 1976. He was replaced by his son, Michael, who served as CEO until 1998. Michael’s nephew, Andrew Jones, took over and continues as CEO.

Over the years, the ownership interest of the founding family has declined. Some of their shares were placed on the stock exchange when the company was first listed. Since then, various holdings have been sold. By 2015, Andrew Jones retained 10% of the issued equity and a further 8% was retained by a number of other relatives.

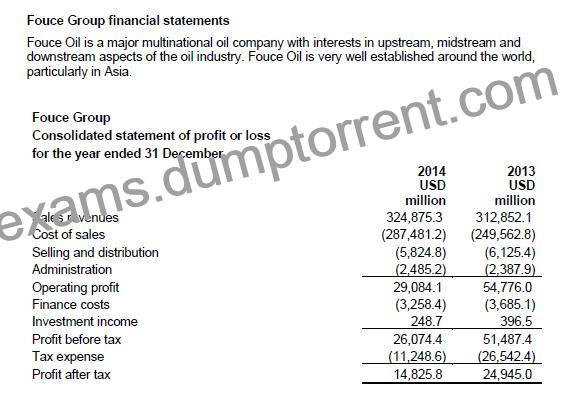

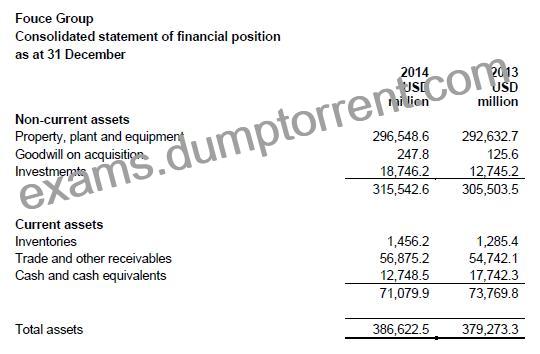

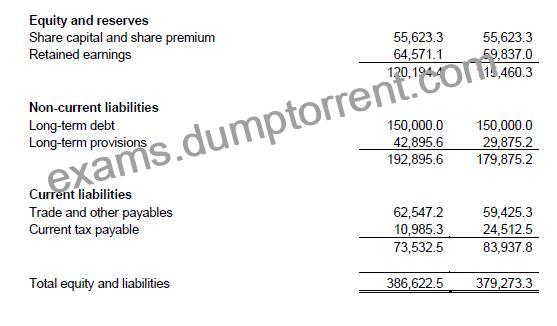

Fouce Oil, an Asian company based in Country C and listed on C’s stock market, purchased 25% of Slide’s equity in 2010. At the time, Fouce Oil made a formal public announcement that it would not purchase further equity shares in Slide. In response to this assurance, Fouce Oil has the right to select two Non-executive Directors to serve on Slide’s Board.

The Slide Group has wholly owned subsidiaries operating in seven countries around the world. Each subsidiary is responsible for acquiring oil exploration rights in its host country and arranging for the necessary work to be undertaken in order to explore for oil.

Kayland’s home currency is the K$.

The oil industry operates on a global basis and virtually all transactions are priced in terms of United States Dollar (USD). Strategic case study exam – May 2015 – pre-seen materials

3 CIMA 2015. No reproduction without prior consent

Oil Exploration

Crude oil is created by natural processes. Organic matter that is trapped underground and compressed while it decomposes can form pools of crude oil over a period of millions of years. The time taken for oil to be created through this process means that it is effectively irreplaceable once it has been extracted and consumed.

Natural gas is formed by the same process. Oil wells often have a pocket of gas trapped above the well. The pressure from the gas can be used to force oil to the surface once a well has been drilled into the rock.

Natural gas can be collected and distributed as a fuel or it can sometimes be regarded as a by-product of oil.

The process of searching for oil requires an understanding of geology. Geologists have discovered that certain types of rock formations are associated with the presence of oil. Geologists conduct surveys that include the analysis of the fossils that can indicate that an area was once rich in the plant and animal life that could have provided the organic matter required for the creation of oil.

Oil fields can be discovered on land or under the sea. Exploration and drilling for oil is possible in either setting, with each offering its own challenges.

If an oil company believes that an area is worth exploring then it must seek permission from the owner of the mineral rights, who is not necessarily the owner of that land or stretch of water at surface level. In some countries the government owns all mineral rights. In other countries it is possible for the surface land and the mineral rights to be owned by different people or entities. Mineral rights at sea generally belong to governments. The law relating to ownership of minerals under the sea can be complicated and national rights can be a matter for international law, with some countries’ rights extending hundreds of miles from the shoreline and others being quite restricted.

Onshore oil drilling rig

Oil companies often supplement the geological surveys with seismic surveys. These involve creating a loud bang by generating a small explosive charge. The resulting sound waves penetrate the rock layer and create echoes, which are recorded for detailed analysis. The echoes can indicate a great deal about the conditions under the rock, including the possible presence of oil.

Seismic survey ship

Ultimately, the only way to ensure that there are exploitable quantities of oil in a particular site is to drill an exploratory well. On land, this would involve building a drilling rig in place. At sea, this would require the use of a special ship or drilling rig that would be anchored in place during drilling operations. Drilling is always expensive and there is always a risk that the well will either turn out to be dry or to contain too little oil to be worth extracting.

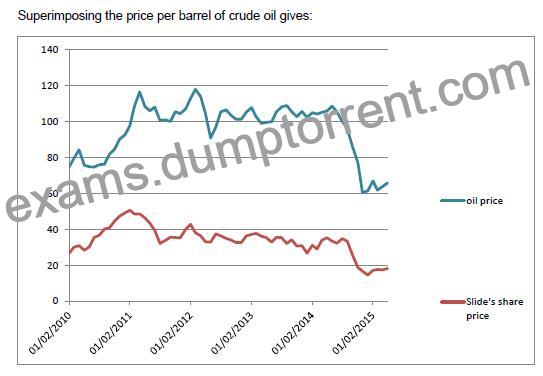

The viability of an oil well can be affected by the price of oil. When oil prices rise it can become financially viable to spend more on extraction and transportation from a well that was previously classed as marginal or even unproductive.

If suitable oil reserves are found then the drilling rig is replaced by a production rig that is equipped to bring the oil to the surface and to pipe it to storage tanks or pipelines so that it can be collected and taken to the refinery.

Crude oil must usually be refined before it can be used. The only major exception being that some oil-fired electrical power stations can burn crude oil as fuel.

Oil refinery

Crude oil is a mixture of different grades of hydrocarbon. These can range from light and volatile fractions such as aviation fuel and petrol to heavier fluids such as diesel fuel and lubricants right down to heavy tars and bitumen. Refining involves separating crude oil into these different grades. Each oil field has its own unique mixture of different fractions, which affects the price.

For historical reasons, quantities of oil are measured in terms of ‘barrels’. A barrel of oil is equivalent to 42 US gallons, which is roughly 159 litres. This measure dates from the times when oil was shipped in barrels, but this is no longer the case with the advent of pipelines and tankers.

The following information is extracted from Slide’s corporate website:

Slide’s business strategy

The oil industry distinguishes ‘upstream’ activity from ‘midstream’ and ‘downstream’.

Upstream activities involve exploring for oil or gas and bringing potentially productive wells into production.

Midstream activities deal with the transportation of oil or gas to the refinery.

Downstream activities comprise the refining of the oil or the purifying of the gas and its subsequent distribution and sale to customers.

Slide’s principal interest is in upstream activities. The company employs a number of leading experts in identifying suitable opportunities for the detection of exploitable oil reserves. It has developed its own models for the discovery of oil in areas that were previously considered to be of limited interest. As a result, Slide often operates in areas where there is limited competition for exploration rights. Slide is also good at finding ways to exploit marginal wells that other companies would regard as potentially unprofitable.

Once Slide has brought a well to production then it will sell the resulting crude oil downstream, but it tends to sell most of its oil wells so that it can release resources from operational wells and concentrate on fresh discoveries. Slide views its strengths as being upstream and so it leaves the midstream and downstream aspects of the industry to larger and more general oil companies.

Slide normally buys exploration rights to investigate on its own account. Slide also makes use of the arrangements to farm-out or farm-in exploration rights.

Farming-in and farming-out are common practices in the oil exploration industry. An oil company can farm-out by granting another company an agreed share of the revenues from a well. It may do so in return for a cash payment, but it is also quite common for the counterparty to this arrangement to offer a particular service instead, such as agreeing to conduct the seismic survey of the area. This means that both companies share the risks. The farm-out arrangement also means that there is less need to fund the costs of exploring and so cash flow is maintained.

A company might decide to farm-in as a speculative venture in order to participate in a successful exploration, or it may offer to farm-in on condition that the primary owner makes use of facilities that it owns, such as infrastructure to support exploration or midstream activities. For example, the company that decides to farm-in may make it a condition that the venture uses a particular subcontractor, in whom it has an interest, to provide the drilling equipment.

Oil companies often rely heavily on specialist subcontractors to supply equipment and operators. That may be because some companies operate in a variety of remote locations and it is cheaper to lease equipment that is already in that geographical region. There can also be a need for specialist skills in operating in particular climatic conditions or on particular geological structures.

Slide’s strategy

Slide’s main strategic priority is to maintain market dominance and become the world leader in oil exploration. The company requires continuing investment in new technology and in skilled employees.

Slides’ directors have prepared the following outline SWOT analysis:

Mission

Slide aspires to become the most successful oil exploration company in the world, while contributing to the wellbeing of people and the environment.

Slide’s strategic objectives for 2014/15 are:

Deliver a sustainable business

* Focus on exploration led growth

* Continue to investigate areas for fracking overseas

* Complete 2015 operations safely and without significant negative environmental impact Maintain a balanced portfolio

* Hold a balanced asset portfolio

* Maintain strong financial statements

Seek growth

* Continue to investigate areas for exploration and diversification

Our Goals

Summary of 2014/15 goals:

Deliver a sustainable business

* Preserve cash for future investments

Maintain a balanced portfolio

* Grow the reserves and resources base to provide the funding for future growth and cash flow Seek operational excellence

* Continue to improve on our operational efficiency

Fracking

Shale rock is found deep underground. This rock contains natural gases and crude oil. Advances in technology over the last ten years have meant that this oil and gas can be extracted from deep underground, even if the shale rock is in a populated area, including formations that extend underneath towns.

In the USA more than a quarter of all gas production comes from shale rock.

Extracting these minerals involves a process called ‘fracking’. Fracking breaks up the shale rock, which releases the oil and gas. Water mixed with sand and chemicals is forced into the rock so that the oil and gas can seep out and be collected.

The oil and gas industry has dismissed claims that fracking is bad for the environment, although it is unlikely that the effects of the process are fully understood. One concern is the volume of water which is required in order to force the water mixture through the rock, another is whether the whole process could affect the stability of the surrounding rock. The oil and gas companies themselves admit in their annual reports that fracking is associated with risks of leaks, spills, explosions and environmental damage.

Widespread use of fracking has reduced the pressure on the USA to import oil and gas. Gas prices, in particular, fell in the USA over the past decade. The price of oil has taken longer to respond to this new source, but recent decreases in oil prices have been attributed in part to the flow of shale oil. Oil and gas from this source has been a huge source of revenue in the USA.

Kayland’s government has been reluctant to allow widespread fracking due to uncertainty over the long term effects, but is interested in the potential revenue stream that could be obtained if fracking was successful. There have been protests outside the offices of many of the larger oil and gas companies because environmentalists claim that the ecosystem is being damaged by fracking and that the long term effects are unknown. However, Kayland’s government has issued some licenses in recent months to large oil and gas exploration companies.

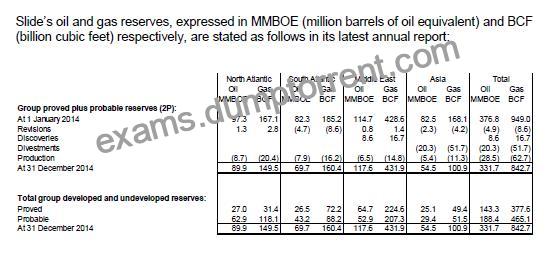

Oil and Gas Reserves

The most commonly accepted definitions of oil reserves are based on those approved by the oil industry in 2007. There are two major classifications of reserves: proven and unproven.

Proven Reserves

Proven reserves are those reserves claimed to have a reasonable certainty, at least 90% confidence, of being recoverable under existing economic and political conditions, with existing technology. Industry specialists refer to this as “P90” or “1P”.

Unproven reserves

Unproven reserves are based on the same type of geological data that are used to estimate proven reserves. However there are technical, contractual, or regulatory uncertainties that prevent the reserves being classified as proven. Unproven reserves are useful for oil companies for future planning purposes. There are two classifications for unproven reserves, probable and possible.

* Probable reserves are reserves which have a 50% confidence level of recovery. The oil industry refers to them as “P50” as they have a 50% certainty of being produced or 2P (proven plus probable).

* Possible reserves are reserves that have a less likely chance of being recovered than probable reserves. These reserves usually have at least a 10% certainty of being produced and are known as “P10” or “3P” (proven plus probable plus possible). Two of the reasons that reserves could be classified as possible are geologists not agreeing on the likelihood of oil and reserves not able to be produced at a commercial rate.

By definition, a reserve must meet four criteria:

1. Discovered – one or more exploratory wells must have been drilled to confirm that oil is actually present.

2. Recoverable – there must be sufficient oil present to make extraction a realistic possibility.

3. Commercial – there should be a firm intention to extract the oil, thereby indicating that it can be recovered and transported from its present location.

4. Remaining – remaining reserves are technically capable of extraction and their potential extraction is deemed profitable.

For example, it would be possible to be certain that there is a reservoir of oil in a particular location, but for that oil to be inaccessible using current technology or it could be accessible, but the cost of recovery could be excessive for the quantity of oil.

Accumulations that are known, but that cannot be recovered because of commercial considerations are known as ‘contingent resources’ and are not included in reserves.

Accumulations that are thought to exist and to be potentially recoverable but that have yet to be discovered are known as ‘prospective resources’.

Slide’s corporate social responsibility statement

Protecting the environment is a key issue for Slide. Slide is an enthusiastic supporter of sustainable development in the oil and gas industry. Slide is determined to use natural resources efficiently while reducing carbon emissions in order to minimise the impact on the environment while still meeting demand for energy.

Climate change and the protection of the environment continue to be among key sustainable development issues in the oil and gas industry. The industry is focused on efficient use of natural resources, the reduction of carbon emissions, and mitigating the impact on the environment while meeting the world’s growing energy needs.

We are concerned that oil leakage and seepage can affect people, wildlife and fish near our sites and work hard to reduce the risks to them. We constantly monitor the environment close to our sites and take immediate action if there are traces of oil found in the surrounding area. We have reduced the number of instances of this problem and last year were pleased to note there were no reported oil leaks caused by our exploration or extraction that required treatment. We are proud of our reputation in the oil industry for caring for the environment.

Carbon emissions are a huge concern for Slide and we make efforts to report these in our annual report and to reduce them each year. We have spent over K$5 million on a new data collection system which will enable us to more accurately measure carbon emissions.

Many of the processes utilised in extraction and production use water which is a scarce resource in many countries. In order to avoid depleting this resource we have taken steps to ensure, whenever possible, that we recycle water and use that in our processes. We also support a charity which helps to provide fresh water in rural areas in some of the areas of the world most affected by water shortages. We provide expert advice from our engineers and geologists as well as practical assistance and donations.

Slide is most concerned for the health and safety of the workforce and others who live close enough to be affected by our processes. We are constantly looking at the health and safety risks and updating our mitigation procedures to reduce accidents and increase our response to them. This is one of our highest priority risks as extraction and exploration is carried out in remote areas which can be difficult to reach. We have spent over K$10 million on training for medical and rescue teams in order to ensure assistance is available for both minor and major issues. Strategic case study exam – May 2015 – pre-seen materials

16 CIMA 2015. No reproduction without prior consent

Slide’s Board of Directors

Andrew Jones, Chief Executive Officer

Andrew is a member of the founder’s family and took over the position in 1998.

Andrew is an Oil and Gas Engineer with a Masters degree in Oil and Gas Engineering. He also has a Master in Business Administration degree from a well-known university in the United States.

Andrew has been credited with driving the company forward to explore for oil in very remote areas with great success.

William Seaton, Finance Director

William has been the Finance Director for six years.

William is an accountancy graduate and is a professionally qualified accountant. He has held senior positions in accounting and finance at two oil exploration companies and was the Finance Director of a large oil company in Africa before he joined Slide as Finance Director.

Vickram De, Director of Innovation

Vickram serves as Director of Innovation and has held this position for two years.

Vickram has a Master of Science degree in Geology and Oil Engineering Design.

Vickram has introduced many innovative ideas for oil extraction which have helped Slide become a leader in innovative practices in the oil industry. His techniques have enabled Slide to buy unproductive wells from other oil companies cheaply and use Vickram’s system of pumping water at high pressure into dormant wells to force oil to the surface. His techniques are widely used in the industry now but he has improved them significantly lately so we are still the leader in the field.

Wilma Descouteau, Extraction Director

Wilma has been Slide’s Extraction Director since 2008. She has a PhD in Oil and Gas Engineering. She was a senior Project Manager in several large extraction projects over a period of eight years. She was a Project Manager with a large French refinery for the previous five years and before that worked in oil extraction projects in the North Sea off the shores of Scotland for six years.

Victor Bogdanovitch, Exploration Director

Victor Bogdanovitch has been Slide’s Exploration Director for four years. Victor has a Master of Geology degree from a major Russian university. He worked in oil exploration in Siberia for ten years before he joined Slide in 2007.

Victor joined Slide to look for potential exploration sites as he had been successful in his previous company and had successfully managed a significant project to explore and extract oil off Siberia. He was made a Director after finding and managing a successful site with huge proven reserves for Slide in 2009. Strategic case study exam – May 2015 – pre-seen materials

17 CIMA 2015. No reproduction without prior consent

James Peterson – Non-executive Chairman

James Peterson has been Slide’s Non-executive Chairman since 2013. He was previously Chief Executive of a major Public Relations company. He has served as Human Resource Director of two other quoted companies during his long and successful career.

James has a Master of Arts degree in Human Resources and Sociology.

James chairs both the Audit and Remuneration Committees.

Sunny Tang – Non-executive Director

Sunny has no experience of the oil industry but has been a successful Finance Director for two media companies for over twenty years.

He is a qualified accountant and has been a Non-executive Director of Slide for two years.

He sits on both the Nomination and Remuneration Committees.

Anne Taylor – Non-executive Director

Anne Taylor has been a Non-executive Director since 2013. She has a background in human resource management and has held senior managerial positions with a number of companies in a variety of industries.

Anne sits on both the Nomination and Remuneration committees.

Sanje Lee – Non-executive Director

Sanje Lee has been a Non-executive Director since 2011. He has had a long career in the petroleum industry. He served as Director of Technical Operations in Fouce for five years before Fouce asked him to become a Non-executive Director of Slide.

Sanje moved to Kayland upon his appointment as a Non-executive Director.

Sanje has a Master of Science degree in Petroleum Technology and a Master of Business Administration degree.

Sanje sits on both the Audit and Remuneration Committees.

Dina Viraj – Non-executive Director

Dina has been a Non-executive Director since 2010. She was previously on the Board of Fouce, and has been selected by Fouce to be a Non-executive Director of Slide. Dina has a Doctorate in Oil and Gas Geology and worked in the field for 15 years.

Dina moved to Kayland upon her appointment as a Non-executive Director. Strategic case study exam – May 2015 – pre-seen materials

18 CIMA 2015. No reproduction without prior consent

Directors’ remuneration

The Remuneration Committee comprises James Peterson, Sunny Tang, Anne Taylor and Sanje Lee. The committee met six times during the financial year ended 31 December 2014.

All Executive Directors receive an annual salary that is intended to be competitive in order to attract and retain suitable Board members. The salary level is decided by the Remuneration Committee, taking account of each individual’s role and experience and the comparable rates offered for equivalent positions. Annual salary increases are generally in line with those offered to employees in general, although there is scope for a more substantial increase in order to reflect any additional responsibilities.

Executive Directors also participate in an annual bonus scheme, again administered by the Remuneration Committee. The total bonus payable is capped at 100% of annual salary. The actual level of bonus awarded is determined by a combination of collective and individual factors.

The collective factors are based upon achievement as measured in terms of Slide’s key KPIs:

* Exploration targets, such as meeting drilling targets

* Development and production targets

* Health and safety

The remainder of the bonus is based on each Director’s achievement of personal objectives, as relevant to his or her role in the business.

The KPI targets associated with bonuses are specified at the beginning of each year and are communicated to the Board. A sliding scale is applied to each element of the KPI targets, linked to actual success in achieving targets.

The annual bonus is paid at the conclusion of each financial year. Bonuses can be clawed back for up to two years in the event of specific conditions such as the discovery of a material error in the figures upon which performance was assessed.

There is also a long-term incentive scheme for Executive Directors. This is also administered by the Remuneration Committee. An amount of up to 300% of annual salary can be awarded in respect of exceptional performance. In this context, ‘exceptional’ is defined in terms of the same measures as the annual bonus, but with more demanding criteria, which are also predetermined at the start of each year and communicated to the Directors. The long-term incentive takes the form of shares and share options that are granted at the end of each year, but which do not vest until three years have passed. Any unvested awards lapse when a Director leaves the company.

The Non-executive Directors receive an annual fee for their services, along with an additional fee for participating in any Board committees. The level of fee is set at a level that attracts and retains good people.

Sanje Lee and Dina Viraj do not receive any fees or salaries from Slide. Their remuneration is both determined by and paid by Fouce.